This article explains how Auto-Deleveraging (ADL) works for Perpetual and Expiry contracts on Bybit Kazakhstan. It outlines what triggers ADL, how opposing positions are selected, and how users can manage their exposure to it.

What is the ADL mechanism?

Bybit Kazakhstan's Auto-Deleveraging (ADL) System helps control the platform's overall risk during liquidation events in extreme market conditions where the insurance fund cannot cover excessive liquidation losses. ADL works by automatically deleveraging profitable or highly leveraged positions on the opposite side of the liquidated positions, based on the ADL ranking.

What is an insurance fund?

The insurance fund is a reserve pool maintained by Bybit Kazakhstan, funded by Bybit Kazakhstan contributions and excess margin from liquidated positions closed at prices better than the bankruptcy price. It is used to cover losses that exceed the margin of liquidated positions. For more information about the insurance fund, please refer to this article.

You can monitor the insurance fund balance on the Insurance History page. Some trading pairs have shared insurance fund pools, while others have isolated pools, depending on the specific risk profile of each project.

You can also access Bybit Kazakhstan's insurance pool data through the API:

- OpenAPI & Web:

- Isolated pool: Updated every minute.

- Shared pool: Updated every 24 hours.

- WebSocket Push:

- Isolated pool: Updates pushed every second.

- Shared pool: No push updates available.

When will ADL be triggered and stopped?

Trigger & Stop Condition 1:

- Trigger condition: ADL will be triggered when the drawdown of a single trading pair over the past 8 hours reaches or exceeds the 8H PnL Drawdown Trigger Line of the insurance fund's highest balance during that period.

- Execution: Once triggered, ADL will calculate the bankruptcy price based on the 8H PnL Drawdown Trigger Line and settle affected positions at the bankruptcy price.

- Stop condition: ADL will stop when the drawdown ratio falls to or below the 8H PnL Drawdown Stop.

To check the parameters for each trading pair, please refer to the Auto-Deleveraging (ADL) tab on this page.

Example 1:

Assume the highest balance of the ABCUSDC insurance fund in the past 8 hours was 20,000 USDC, with the Drawdown Trigger Line and Drawdown Stop of 30% and 25%, respectively.

- Currently, the position margin for open interest in ABCUSDC is 1,000 USDC, and the total realized and unrealized losses from these positions amount to 8,000 USDC. The drawdown ratio is therefore calculated as (8,000 − 1,000) ÷ 20,000 = 35%. Since the ratio exceeds 30%, ADL will be triggered.

- Once ADL is triggered, the insurance fund will calculate the bankruptcy price based on a 30% drawdown limit. Users will then compensate 2,000 USDC (8,000 USDC − 20,000 USDC × 30%) to the insurance fund, bringing the drawdown back to 30%.

- If, later, due to market recovery or ADL replenishment of the insurance fund pool, the drawdown of the ABCUSDC insurance fund falls to or below 25%, the stop condition will be met, and the ADL process will stop.

- The bankruptcy price is calculated as:

- For long positions: Entry price + (PnL calculated from the maximum loss when ADL is triggered ÷ Total open position size)

- For short positions: Entry price − (PnL calculated from the maximum loss when ADL is triggered ÷ Total open position size)

Trigger & Stop Condition 2:

- Trigger condition: ADL will be triggered when the combined balance of multiple trading pairs with independent insurance fund pools falls to or below 0.

- Execution: Once triggered, ADL will treat the combined insurance fund balance as 0, redistribute the insurance fund based on each trading pair's profit and loss ratio, and calculate the bankruptcy price accordingly.

- Stop condition: ADL will stop when the combined balance of the independent insurance funds rises above 0.

Example 2:

Assume ABCUSDC, BCDUSDC and CDEUSDC each have independent insurance funds.

- Currently, the combined balance of the three insurance funds is below 0 → ADL is triggered.

- Among them, only BCDUSDC's insurance fund has a positive balance, while the others are negative.

- Execution logic:

- ADL will be triggered for the BCDUSDC position, and its positive balance will be redistributed to the insurance fund pools of ABCUSDC and CDEUSDC to offset their losses.

- After redistribution, the system will check again whether Condition 1 or Condition 2 is still met.

- If the combined balance turns positive (> 0), the stop condition will be met and the ADL process will end.

- The bankruptcy price is calculated as:

- For long positions: Entry price + [0 − (Redistributed amount + Total open position margin) ÷ Total open position size]

- For short positions: Entry price − [0 − (Redistributed amount + Total open position margin) ÷ Total open position size]

How does ADL work?

When ADL is triggered, liquidated positions are taken over and closed by matching with opposing profitable or highly leveraged positions, i.e., the Deleveraged Positions. Once a match is made, both positions will be offset and closed at the bankruptcy price defined by the insurance fund.

In summary:

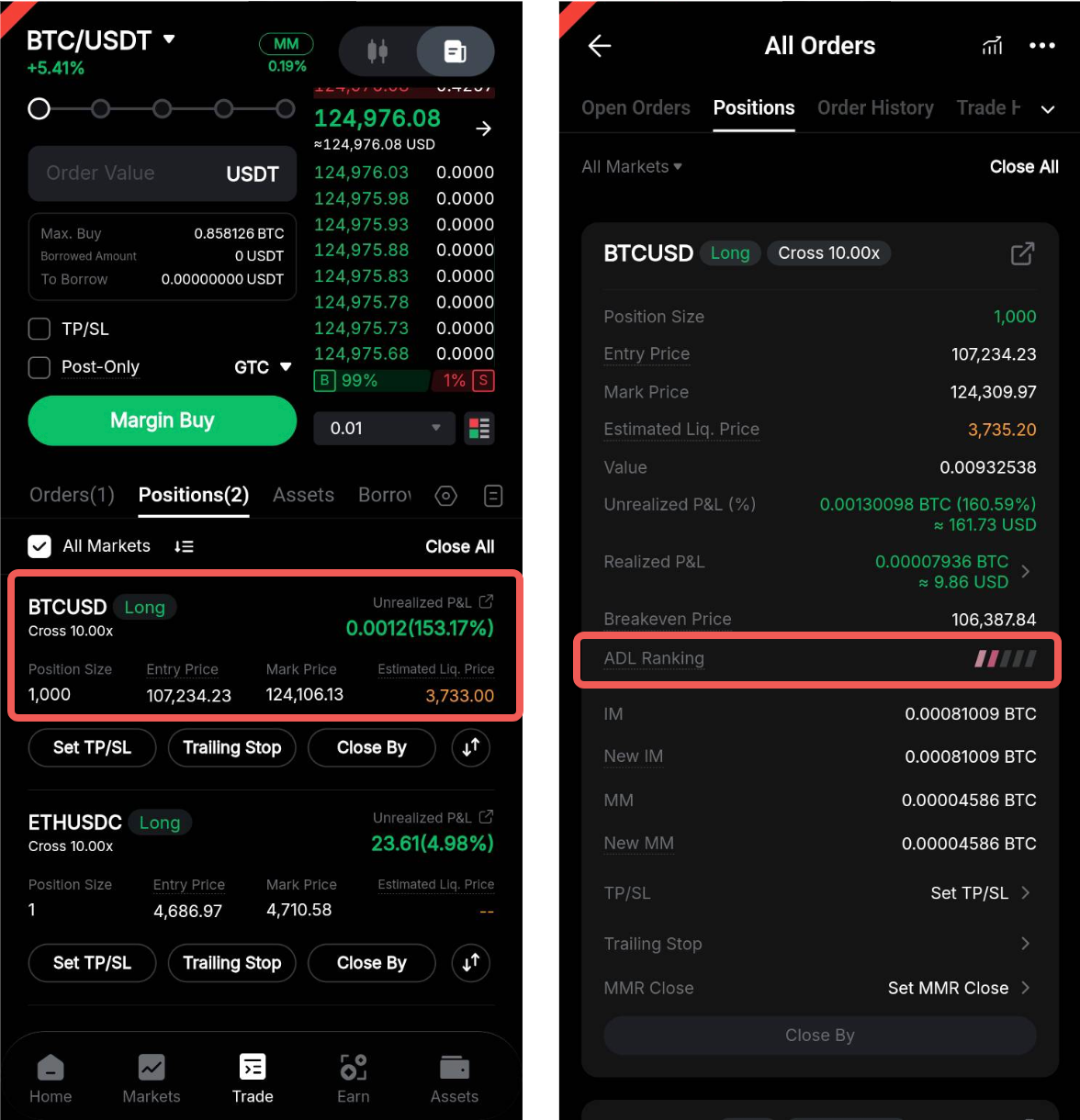

- Traders with the highest ADL rankings are selected first for deleveraging. Traders can refer to the ADL priority lights on their positions to estimate their ADL rankings.

- The ADL ranking is based on the leveraged return. Accounts with higher leveraged returns are ranked higher.

- Selected positions will be settled at the bankruptcy price of the liquidated positions taken over by the system.

- Any amount difference between positions closed automatically at the bankruptcy price and the market price will contribute to the insurance fund pool to cover the excess losses.

- Traders whose positions are selected for ADL will receive email notifications and have all active orders canceled. They can re-enter the market at any time.

How is ADL ranking determined?

The ADL ranking is determined based on the leveraged return of a position. Please note that opposing positions that are at a loss may still be selected, but those in profit are given priority.

The specific rules are as follows:

Example

Assuming there are six short positions on the exchange, the trader with the highest ranking in the system will be prioritized and selected for deleveraging first. The ADL ranking is determined in descending order of leveraged return. The opposing position of the selected trader will be deleveraged at the bankruptcy price of the liquidated position.

Assume the insurance fund takes over long positions of 5,000 contracts, but the insurance fund is unable to fully cover the losses.

According to the ADL ranking table, Trader A is ranked highest in the auto-deleveraging queue. Trader A will be selected by the ADL system, and 5,000 contracts will be forcefully closed by matching with the liquidated positions. The remaining 500 contracts in Trader A's position will be retained. After being auto-deleveraged, Trader A still uses the same margin but holds a smaller position. As a result, Trader A may no longer be the top-ranked trader in the ADL queue.

Similarly, if 10,000 contracts need to be auto-deleveraged, Traders A, B and C will all be selected.

A maker fee will be charged to the ADL traders whose positions are reduced, while a taker fee will be charged to the trader whose liquidation triggered the ADL. Traders who experience auto-deleveraging will receive notifications via email and/or SMS. All of their active orders will be canceled, and they are free to re-enter the market at any time.

How to check the ADL ranking

Traders can check the ADL ranking of each position from their Positions tab.

On the App

On the Website

How to reduce ADL exposure

You can reduce your exposure to ADL by lowering your leverage or partially closing your positions in profit.

- Lowering the leverage will lower the ADL ranking in real time.

- Partially closing a highly leveraged position can reduce the number of contracts exposed to ADL risk, although it won't lower your ADL ranking.

- If partial closing doesn't fully address your concerns, consider fully closing your open positions.